What is Home Equity line of credit | Home Equity loan

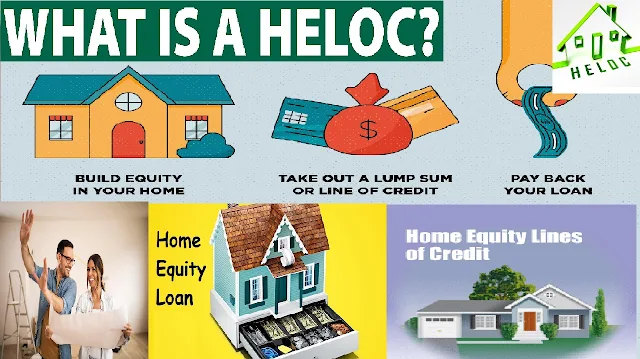

What is Home Equity Line of Credit?

Home Equity line of credit [HELOC]

What Is Home Equity Line of Credit (HELOC)- Friends, if you also do not know about Home Equity Line of Credit, then today you will be able to know about it completely. So let's understand with an example.

Read Also-NX Student Edition free download for windows

In Home Equity Line of Credit [HELOC], 50 to 60 percent of the value of the house is given after deducting the EMI amount from the market value of the house. It can increase up to 80%. So in this way Ram takes loan from here, and takes forward the business of his elder boy.

Table of contents

- What is Home Equity Line of Credit?

- How to get equity line of credit?

- How much loan can I take from Home Equity Line of Credit?

- Benefits of taking home equity loans

- Disadvantages of Taking a Home Equity Line of Credit

1. What is Home Equity Line of Credit?

In Home Equity Line of Credit (HELOC), you can get a loan of 50 to 60 percent of the market value of the house you have built. And you can use it to fill the EMI of your house, it can be used for any other work. You can also get this amount for payments up to 15 years.

There is less paperwork on this, and here you are provided with a very cheap loan. Home equity loan rates are available at interest between 3 to 4 percent.

2. How to get Home Equity Line of Credit?

In Home Equity Line of Credit, you can get a hefty amount on interest on the house you have built. For this, many financial companies and banks provide this facility. From where you can take a loan of 50 to 60 percent of the market value of your house.

If there is an EMI going on your house, then after deducting it, you can get a loan of 50 to 60 percent of the market value and in some circumstances up to 80%. This loan is provided to you by banks and many other financial institutions. Which you can use to pay your home EMI amount or meet other needs.

3.How much loan can be taken from Home Equity Line of Credit?

If you have your personal house and it is fully built, then you can pay 50 to 60 percent of the market value on it and if there is any EMI of your house, then by deducting it, you will get the market value of the house in some cases. Loan up to 80 percent can be availed.

4.Benefits of Taking Home Equity Loan

- If you have your own house then you can take huge amount on loan from here.

- Very little interest is charged on the loan amount availed from here.

- You can easily get this loan on your house.

- By taking a loan from here, you can pay the EMI of your house already being paid.

- You can use the amount received from here for your business or any other work.

- There is no restriction on the purpose for which the loan is used.

- If you want, you can also repay the loan amount taken ahead of time.

5.Disadvantages of Taking Home Equity Line of Credit

- This loan is available on the house built by you and it is also seen that you have ownership rights on the house and there is no dispute on it, then only you are given the loan.

- If you do not have a house of your own, then you cannot take a loan.

- In case of non-payment of the loan taken on the house, that financial institution or bank has the right on that house.

- Which the bank or any financial institution wants, can be recovered by selling or auctioning.

Home Equity Line of Credit [HELOC] FAQ

1.How is equity calculated?

The information of all the shareholders of the company is available on the balance sheet of the company. It is calculated by subtracting total assets from all liabilities. If the equity is positive, the company has enough assets to cover the liabilities. And if the equity is negative, the company's liabilities exceed its assets.

2.How do I calculate 20% equity in my home?

To determine the fair market value of your home, appraise it by its market value and subtract any mortgage or mortgage amounts that are owed on it. Contact a professional appraiser for the correct appraisal. After that you will get your 20% equity.

3.What is equity formula?

The equity formula states that the total value of a company's equity is equal to the sum of its total assets, which is the sum of its total liabilities.

5.How long is a home equity loan?

A home equity loan is a free cash repayment secured on a home that the lender can repay within 5 to 30 years as per the convenience and terms of the home equity.

6.How do you get equity in your home?

- To avail an equity credit line loan on your home, you need to make your past mortgage payments.

- If there is a big payout, you can preform it and make it smaller. With this you find new sources of income.

- Increase your down payment. With that you can wait for the value of your home to increase.

7.Can you use home equity to buy another home?

You can mortgage your first house to buy another house. You can use the equity of your first house. If the value of your old house increases by 80 percent, you can use the equity of the first home as a down payment to invest in a new property.

9.Can I take money out of my house equity?

You can take an equity loan of 80-85% of the market value of your house. The valuation of your house is done according to the market value. If there is an old home EMI going, then the value that comes after deducting it, the equity of that house is calculated.

10.What is the monthly payment on a $100 000 home equity loan?

If you take out $100,000 on a 30-year mortgage at 4 percent, you'll need to make a monthly down payment of $477.415 which is inclusive of all taxes.

11.What is a monthly home equity loan payment?

A home equity loan is a mortgage, which means a loan that is fully secured by your property. When you get a home equity loan. So you can also pay it with a free amount or you can pay it in 5 to 15 years as per your convenience.

12.Can I get a loan if I own a house?

Yes, if you have your own house then you can take Equity Credit Line Loan on it which can give you 60 to 65 percent of the market value of your house.

13.What is 20 equity in a home?

20% Equity on the house means that if the value of your house is ₹ 2000000 then you will have to make a down payment of ₹ 40000 on the basis of 20% interest on it.

14.What is equity financing?

Equity financing means that all the shareholders of the company, after deducting all the liabilities of the company from their assets, if there is some profit, then it is distributed among the shareholders, which is calculated from many factors.

16.What is a good equity ratio?

What makes a good equity ratio? Normally a good equity ratio which we divide by .5 or 50% which is kept among the business owner of the business.

17.What is bank credit line?

Bank credit line is a flexible loan taken from banks or financial institutions. In this, as soon as the money is borrowed, a line of credit is started for recovery of interest on that borrowed money, which is determined by the borrower to pay it on the approval of the bank and its relationship and rating with the banks. works to do.

18.How soon can I get equity loan?

If you have your own house then you can apply for Equity Home Loan. But if you do not have your own house then you have to buy a new house and after that you can apply for an equity home loan by making the down payment principal for 5 to 7 years.

%20(1).jpg)